Mileage Tracker by Driversnote

Mileage Tracker by Driversnote ਦਾ ਵੇਰਵਾ

Your easy-to-use mileage tracker:

Automatically track your mileage with Driversnote and we’ll generate the reports you need for your Revenue Commission tax deduction and company reimbursement.

⭐⭐⭐⭐⭐

•“Easy to use, keep records & email direct to office” - Chris E, July 2020

•“This app really helps me keep track of my miles.” - William B, June 2020

•“Totally reliable, it does everything our small business requires” - Steve G, March 2020

•“It logged all my mileage accurately and gave me the option to export the data for my taxes.” - Brittany K, March 2019

🚘 Driversnote mileage log is ideal for businesses, employees, employers, self-employed and just about anyone who drives.

🤝 Trusted by over 1,000,000 drivers for our mileage tracking & reporting solution.

🤓 Always up to date with the Civil Service rates. Easily generate Revenue-compliant reports ready for mileage reimbursement.

🏆 The best vehicle log for Android. Driversnote is the only app you will ever need for mileage tracking & reports.

💰 Maximize Your Mileage Reimbursement:

For every km you log this year, you can get reimbursed up to 83.53c. Start your kilometre tracking in our logbook today.

⏰ Save Time & Increase Efficiency:

Want to track your trip? Just tap START and STOP and leave the rest to our smart GPS tracker.

💯 100% Automatic Start & Stop with iBeacon Support:

Get a free iBeacon when you sign up for the annual Basic subscription.

🗒 Online Mileage Log:

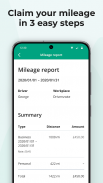

Your complete mileage log is always ready for you online. Easily print or download your car logbook as a PDF or Excel document.

📱 Log trips easily with your phone

•Use our mileage tracker to follow your trip through GPS as you drive.

•Manually record a trip and our app will automatically calculate the distances between your start and end points.

•Mileage reimbursement, distances and odometer readings are calculated automatically - it doesn’t get much easier than that!

•Add or edit trips in the log at any time, if you forgot to use our smart GPS tracker.

•More than one car or workplace? No worries, you can use logs in one account for multiple cars and workplaces.

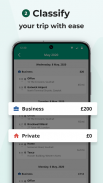

✔️ Fully compliant with Revenue requirements for tax deductions

•Easily categorize your trips within the car logbook.

•More than just a kilometre tracker; we generate complete mileage documentation that also complies with Revenue requirements.

•Option to attach a comment to each recorded trip.

•Add Odometer readings with ease, if you need them. You decide how often you check your odometer and let us do all the math in between.

🚗 Mileage tracker with 100% automatic start & stop capability

•Place an iBeacon in your car and Driversnote will track your kilometres all by itself.

•Zero-touch journey tracking - leave your phone in your pocket, we’ve got you all the way.

💻 See your complete mileage log online

•All your registered trips are saved on our servers automatically.

•Get the full overview of your trips on www.driversnote.com.

•Forgot to track a trip? Log trips manually for maximum mileage allowance.

•Your complete mile log is always ready for you online, and you can easily print or download your car log as a PDF, Excel doc, or more.

🌏 What countries do we support with our mile tracker?

•Our mile tracker supports most countries and we already have default government mileage tracking values entered for Ireland, UK, USA, Canada, Australia, NZ, Denmark, and Sweden.

•If your employer uses a different rate, you also have the option to enter your own mileage tracking rates in the app.

•All addresses, currencies etc. will be formatted for local standards. If you have any questions about our mileage log solution, feel free to contact us.

🙋 Support

If you have questions or feedback about our mileage tracker & log solution, please contact support@driversnote.com or call us at (+45) 71 99 37 54.